Trade currency pairs online

Start currency trading on tight spreads with flexible leverage and pro market analysis tools

Major currency pairs

Go long or short on major currencies against the USD like EUR/USD (Euro Dollar), USD/CAD, AUD/USD and GBP/USD.

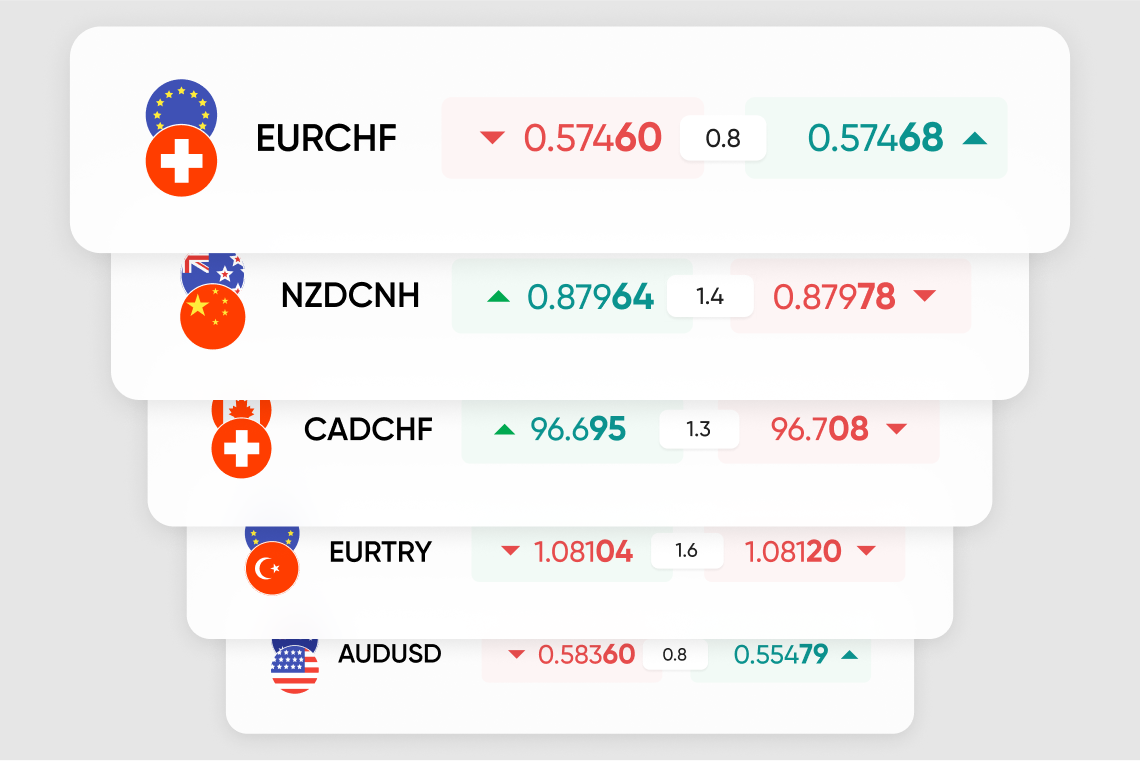

Minor currency pairs

Trade the price swings of powerful currencies in pairs that don’t include the US dollar, such as GBP/EUR, AUD/CAD and CHF/JPY.

Exotic currency pairs

These might be traded less often, but trading major currencies against emerging markets can create huge price swings - and returns!

| Column 1 | Column 2 | Column 3 |

|---|---|---|

| n/a | n/a | n/a |

| n/a | n/a | n/a |

| n/a | n/a | n/a |

| n/a | n/a | n/a |

| n/a | n/a | n/a |

Competitive currency prices

Trade on currency pairs on global online marketplaces with added leverage. Foreign exchange trading lets you capture profits from global market dynamics and speculate on the rise or fall of a currency value without needing to directly own the asset. Access one of the largest and most liquid financial markets in the world with a free live trading account.

EUR/USD on spreads from 0.0 pips

Currency Trading FAQs

How can I start trading currencies online?

Sign up for a free Equiti trading account to start trading currency pairs on global marketplaces. Trading currencies allows traders to potentially profit from the increased (or decreased) value of a country’s currency in comparison to another. Each currency has an official abbreviation - in this case, EUR means ‘Euro’ & USD means ‘United States Dollar’.

Login to begin your currency trading journey and see today’s currency prices.

What is a pip in currency trading?

A pip, short for ‘point in percentage’, is a very small measure of change in the value of a currency pair on the foreign exchange (currency exchange) online market. It can be measured in terms of the quote or the underlying currency. It is a standardised unit for the smallest amount by which a currency quote can change, which is usually $0.0001 for USD-related currency pairs. A fractional pip or point is equivalent to 1/10 of a pip and there are 10 points to every 1 pip.

When trading currency pairs, spreads with low pips (0.0 pip spreads) indicate that a product is traded very frequently but pips can also be used for risk management tools like Stop Loss orders. Knowing your currency pair’s pip value allows you to manage your risk exposure, and potentially make the same profit across pairs. For example, if your Stop Loss equals 50 pips, the Take Profit could be 100-150 pips - as many think that having a SL/TP ratio of 1:2 or 1:3 is a good benchmark.

What do ‘rolling futures’ for currency pairs mean?

A rolling futures contract, also known as a continuous futures contract or a perpetual contract, is a financial product that allows traders to speculate on the future price movements of a particular asset, such as currency pairs, without an expiration date. In traditional futures contracts, there's a set expiration date, after which the contract must be settled. However, rolling futures contracts are designed to eliminate the need for expiration by continuously rolling over from one contract period to the next.

For currency pairs, rolling futures contracts work similarly. Instead of expiring at a specific date, these contracts are structured to maintain continuity by automatically rolling over from one contract period to the next, typically on a regular schedule. This process involves closing out the expiring contract and simultaneously opening a new one for the same underlying asset, maintaining the trader's exposure.The price of a rolling futures contract is usually based on the spot price of the currency pair plus or minus any adjustments based on factors like interest rates, dividends, or other market conditions.

Advantages of trading currency pair futures include:

Continuous exposure and long-term hedging: This allows traders to keep their positions open without needing to close out and open new positions when contracts expire.

Liquidity and flexibility: Futures often have higher liquidity which gives traders more flexibility when entering or exiting online markets compared to traditional contracts.