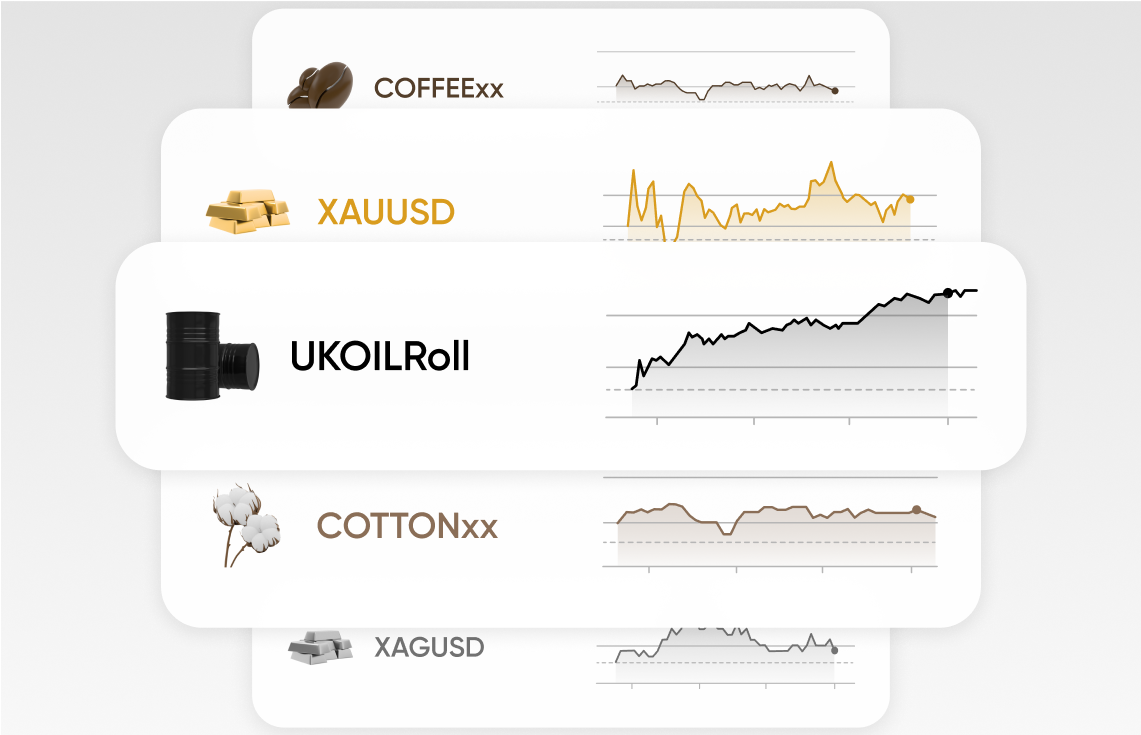

Trade oil and gold online

Grow your investment portfolio by trading commodities like oil, gold and precious metals

Gold & Metals

Take a position on Gold, Silver, Platinum or Copper against major currencies like USD.

Oil & Gas

Tap into the potential of raw materials like Natural Gas, WTI and Brent Crude Oil.

Crops & Agriculture

Trade on prices of globally traded soft commodities or crops like Cotton and Coffee.

Commodity market trading

We offer current options and futures for commodity trading so you can buy and sell assets exactly the way you want to. Benefit from short-term price fluctuations or buy or sell assets at a predetermined future price. Futures trading lets you speculate on price movements and hedge against potential risks (like drought affecting crop production) without needing to directly own the commodity itself, leveraging a contract’s value. Open an account to explore opportunities trading gold, crude oil and crops online.

Commission-free US oil rolls

Commodity Trading FAQs

How can I start trading gold online?

Sign up for a free Equiti trading account to start trading gold online as futures or current assets. You can buy and sell gold assets with live prices from global commodity markets on secure trading platforms with free AI and analytical tools. Our economic calendar will keep you updated of upcoming central bank decisions and other financial events that can impact the prices of gold.

Login to begin your gold trading journey and see today’s gold and gold future prices.

How can I start trading crude oil online?

Sign up for a free Equiti account to start trading major oil benchmarks like WTI and Brent Crude oil. All oil assets are available on tight spreads with flexible leverage, and our US oil rolls are commission-free on any account. Customise your oil trading performance with interactive charts and stay ahead of market trends with advanced analytical tools.

Login to start trading crude oil online today.

What is commodity market trading?

Commodity market trading involves the buying and selling of raw materials or primary goods. These assets can function through various means, including futures contracts, options, and spot markets, allowing traders to engage in both short-term and long-term trading strategies based on supply and demand dynamics, geopolitical factors, and global economic trends.

Trading commodities as current assets involves buying and selling tangible goods like gold, silver, oil, natural gas, cotton, and coffee for immediate delivery or use. Traders purchase contracts on commodity markets to benefit from short-term price fluctuations or to diversify their trading portfolio which helps manage risk.

Another alternative to current commodity asset trading is to trade commodities as futures. Trading commodities as futures involves agreements to buy or sell these goods at a predetermined price on a future date. Futures trading allows investors to speculate on price movements and hedge against potential risks, leveraging on the contract’s value instead of directly owning the physical asset. Both approaches offer unique opportunities and challenges based on market conditions and a trader’s risk appetite.

What tools should I use for commodity trading?

Several market analysis tools are popular among commodity traders for making informed decisions. Some of the key ones include:

Supply and Demand Analysis: Understanding the balance between supply (production) and demand (consumption) for a specific commodity helps in predicting price movements. These are popularly tracked with resistance levels - which are lines that can be added to interactive trading charts.

Technical Analysis: This involves studying historical price data, trading volume, and chart patterns to forecast future price movements. Indicators like Moving Averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence) are commonly used. Many trading platforms like MT4 and MT5 will include computer-generated analysis tools to make identifying chart patterns easier for individual traders.

Fundamental Analysis: Analysing broader economic factors, geopolitical events, weather patterns, and government policies affecting the commodity's supply and demand helps in making long-term predictions. For example, political conflict will likely push up the price of gold as currencies falter, and droughts may increase the price of crops as supply reduces.

News and Market Sentiment: Staying updated with news, events, and market sentiment around the world significantly impacts commodity prices. Traders often monitor news sources and social media for real-time information. The Equiti Portal includes live news updates and a full economic calendar so that Equiti traders can access all the information they need to make smarter trading decisions in one place.